A commercial lease agreement is a contract drafted between a landlord and tenant of a property that can be used for business-related purposes. The agreement may be used for a vast range of commercial property such as retail (ex. store, restaurant, cafe, etc.), office, and industrial property.

Commercial Rental Application – Recommended for the landlord to verify the tenant is credit-worthy to sign a commercial lease.

Gross Lease – The tenant is responsible for paying a single amount to the landlord every month. While the landlord is responsible for all utilities and expenses related to the property including utilities, common area maintenance (CAM’s), insurance and property taxes.

Booth Rental – Common for hair salons and massage parlors. In either setting, the person renting the booth is considered an independent contractor and commonly is required to pay a monthly amount in addition to a percentage (%) of their total earnings.

Land Lease – If the tenant is seeking to build their own building on the property the landlord and tenant may enter into what is known as a ‘land lease’ which is just renting of the land. The tenant will have rights to build on the property or access for minerals. A land lease usually consists of a minimum of 10 years with renewals and/or options to extend for another 10 to 25 years.

Lease-Purchase Agreement – Allows the tenant to purchase the property during the course of the lease commonly for a predetermined sales price.

Modified Gross Lease – Landlord and tenant share the expenses of utilities and services including common area maintenance (CAM’s), insurance, and real estate taxes.

Percentage Lease – An agreement that requires the tenant pays a portion or all of the rent in accordance with a percentage of sales at the location.

Triple Net (NNN) Lease – The tenant is responsible for paying a sum every month to the landlord in addition to paying all the expenses related to the property including but not limited to: utilities, common area maintenance (CAM’s), property insurance and taxes. This is common in urban areas and among larger companies that want to be in charge of their own expenses.

Sublease Agreement – When the tenant of a commercial property decides to re-rent the property to someone else.

The price per square foot ($/SF) is a number that represents the annual rent for commercial space. It is calculated by the annual rent ($) and divided (÷) by the total square footage (SF) of the space. Unless it is a land lease, this is for the “living space” of the property which is calculated by measuring the interior walls (the width multiplied by the length).

A landlord is offering 2,500 square feet of space at $50,000/yr. The calculation would be $50,000 divided by 2,500 square feet which would equal $20/SF.

A landlord is offering 1,500 square feet of space at $3,000/mo. The calculation would be $3,000 multiplied by 12 equaling $36,000. Then you would divide $36,000 by 1,500 square feet equaling $24/SF.

A landlord is offering 4,500 square feet of space at $15/SF. The calculation would be 4,500 square feet multiplied by $15 equaling $67,500 in annual rent. Divide $67,500 by 12 and $5,625 is the monthly rent.

Negotiating a commercial lease, whether in the landlord or tenant position, depends on a number of factors primarily being market conditions, location, and the property itself. Due to each parcel of real estate being unique, a lot of the negotiation will be determined by the landlord’s eagerness to rent the space and the tenant’s willingness to pay the asking rental amount.

A real estate agent is commonly considered an expert in the market area and will know the rental rates for similar properties. This benefits the landlord and tenant into coming into an agreement that mutually benefits each party.

A Realtor will typically charge a commission that is based on the total lease term. For example, if the lease term is for 10 years, the annual rent is $50,000, and the commission is 5%, the total commission will be $25,000 upon the lease being signed ($50,000 multiplied by 10 years = $500,000. Then multiply the total amount by 5% which is $25,000 paid to both agents combined).

If the landlord is offering a price that seems higher than the norm, the tenant should conduct their own investigation of what rents are going for in the area. The best websites to view commercial property listings depend on the market area. The most popular sites nationally are as follows:

If the landlord or tenant hired a real estate agent, they should be able to pull comparable leases that have been signed to show as proof of the rent being paid by other similar tenants and properties. This should give an idea to both parties a rental range.

Pulling property data is not as difficult as it sounds. Especially for retail tenants or shop owners that depend on the traffic and demographics. Traffic counts for example, which is the average daily number (#) of vehicles that drive-by on a particular street, are provided free by the Dept. of Motor Vehicles in the State. In addition, demographic data can be found by going to the US Census Bureau and look up the county and town income levels.

For example, properties in higher traffic areas and higher median income levels will commonly fetch higher rent amounts due to the excess of disposable income.

If the tenant has a good history of paying their creditors on time or has a business with multiple locations chances are the landlord will take that into consideration when negotiating the rent. For example, companies with BBB+ or better credit ratings will give the landlord incredible value for their property if they are ever to sell. Therefore, landlords will always be encouraged to sign a credit tenant rather than a new business.

Check a Business’s Credit Score

Bad Credit

If the business does not qualify or the business has a poor credit rating, the landlord can always request the tenant sign personally with a personal guarantee. This will make the owner of the business, provided they have the necessary assets, to sign personally for the lease. In other words, if the tenant defaults on the lease, the landlord will be able to acquire the tenant’s personal assets such as their vehicles, home, and personal finances in order to recoup their losses under the tenant’s obligations under the lease agreement.

The last option the tenant has in order to attempt having a lower rent amount is to try and pay as much upfront as possible at the time of lease signing. Ideally, if the tenant is able to pay, at a minimum, 6 to 18 months in rent it may sway the landlord into a lower amount.

In addition, if the tenant is able to put up as much as possible as the security deposit that also helps the landlord in determining whether to sign the agreement.

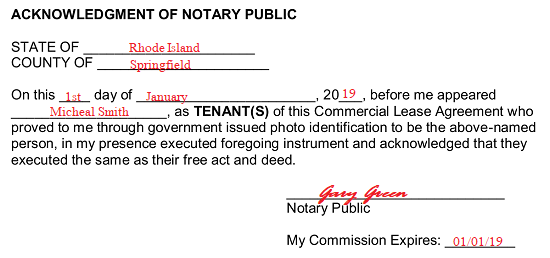

There are three (3) ways to sign a commercial lease agreement: in-person, electronically, or with a notary public (recommended). All three (3) types are legal in the United States, although, signing with a notary public as the witness offers the most protection against any claim that the agreement was not authorized by any of the parties involved.

Signing in-person involves either the landlord and tenant arranging a time to meet and signing multiple copies so that each party is able to obtain an original for their records. If the parties are able to find any third (3rd) parties it is best to have at least one (1) or two (2) witnesses that have no relation to the parties and nothing to gain siding with the landlord or tenant. After the lease is signed in-person the parties should each take an original with the agreement now determined to be legally binding.

Effective June 20, 2000, the United States passed the Electronic Signatures in Global and National Commerce Act (Public Law 106-229) which allows two (2) parties to enter into an agreement online. Today, there are many services that provide this service such as DocuSign, EverSign, and HelloSign. All three (3) companies allow for a free trial (up to 5 documents for free) and have limited fees thereafter.

The highest recommended option is for both parties to sign in the presence of a notary public. This confirms that each party signed the agreement as a licensed notary requires State ID of each individual that is signing. When a document is notarized, there is little question or doubt that the individuals that authorized the agreement are in fact who they claim to be. Therefore, for commercial leases, especially those with high financial liability, it’s recommended both parties sign with a notary present.

A comprehensive commercial lease can often be more than 10, 15, and even 20 pages for agreements with numerous obligations to each party. Below is a list of the most common types of clauses in a commercial lease that may help serve both landlord and tenant.

No matter the commercial lease type, there should be terms and conditions for both landlord and tenant in regards to either party defaulting on the agreement. In most cases, default occurs when the tenant can no longer pay rent. If either party is no longer upholding their end of the agreement, it’s recommended that there are monetary penalties for either side.

If the property has more than one (1) tenant, such as a retail building or mall, the tenant can request “exclusive rights” to the only type of retailer on the property.

For example, if the tenant is a hair salon, the tenant may request that the landlord not allow any other hair salons to rent on the property. Therefore, the tenant would have “exclusive rights” on the property.

Allows the tenant to buy the property for either pre-determined terms or at a price to be negotiated when the tenant gives notice of their intent to purchase.

An option to terminate the lease commonly will be at a price so large that only under extreme circumstances would it make sense. This is usually a penalty equal to a financial value.

HVAC is an acronym for Heating, Ventilation, and Air Conditioning. Expenses related to an HVAC system are either the responsibility of the landlord or tenant. It is important to detail who is responsible and for the tenant to have the HVAC system inspected upon lease signing if they are to be responsible for costs and maintenance.

The right of first refusal is common for single-tenant properties as, in some cases, they would benefit most by purchasing the property. If the tenant owned the property, they would be in charge of just the mortgage payment (if purchased with a loan) and would no longer have to fear future rent increases.

Renewal periods and options to renew allow the tenant to extend the lease at a pre-determined rental rate at their sole option. Most large companies require their leases have renewal periods for long-term planning and grant them the option to continue leasing the property.

For Example, most department stores do not own the property they are located. They lease the property for an initial term of twenty-five (25) years with five (5) separate ten (10) year options to renew at pre-determined rates. This gives the department store the benefit of renewing their lease at a past rate which is usually much lower than current market conditions.

More common in urban areas, if the tenant has the right to sublet or assign the lease it means they can re-rent the property to someone else. The landlord will commonly make terms or conditions to ensure that any new tenant is an ideal fit for the property.

It is advised that any commercial lease is signed in the presence of a notary public and/or third (3rd) party witnesses to protect each party.

There is no easy way to terminate a commercial lease and often requires the landlord’s consent. The most common reason termination is requested is if the tenant is not able to pay the monthly rent any longer. If the tenant has realized their business plan is no longer working and has assets they would like to protect or signed personally on the lease making them financially liable, chances are they will want to make a deal with the landlord. On the other hand, most landlords want their property to have a business that is successful as their tenant for their own security, therefore, approaching the landlord with a deal that benefits both parties may suffice.

If the landlord has intentions of terminating the lease, it will depend on the tenant’s success as an operating business and how much it would take to “buy-out” their lease. Most tenants, knowing that they will be forced to vacate at the end of their lease term anyway, will most likely be open to making a deal with the landlord.

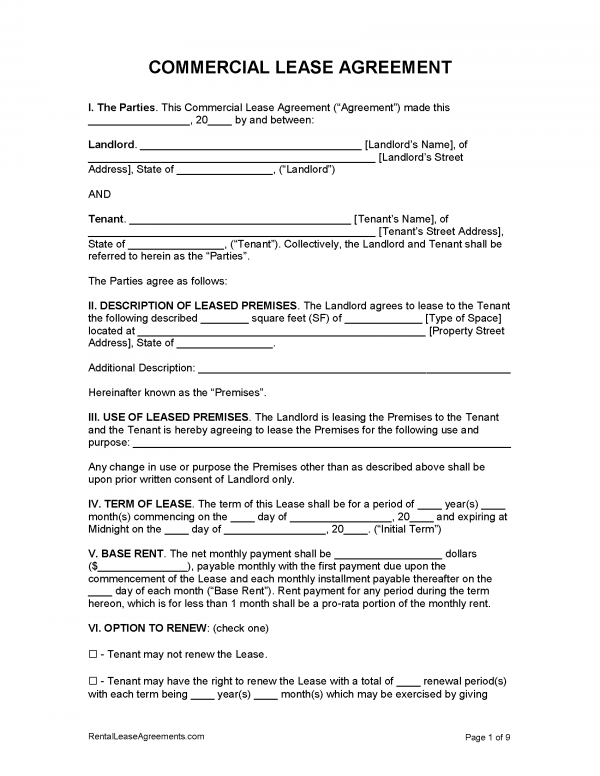

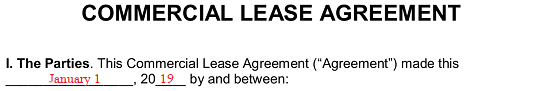

1 – The Lease Template Can Be Saved In One Of Three Formats

The contract previewed in the windowed image on this page can be used to solidify a commercial lease agreement between a Landlord and a Tenant. Save this contract template to your machine by selecting one of the buttons presented above (“MS Word,” “Adobe PDF,” “ODT”).

2 – Submit The Requested Information To Initial Declaration

This contract will be divided into several articles. It is imperative that both the Landlord and Tenant read each of these articles before providing their signatures. Before this action is committed however, some of these articles will require information directly input in areas that must specifically apply to both the signature parties and the premises. The first sentence in the first article will contain several empty lines. The first two of which should be used to display this contract’s official calendar day, month, and year

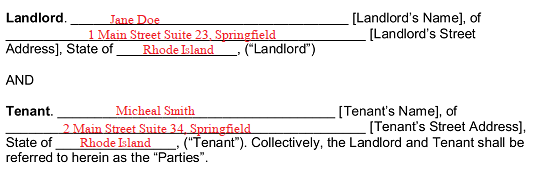

The signature parties entering this agreement will have to be named at the onset of this agreement. In the first article, notice the two labeled areas “Landlord” and “Tenant.” Each of these areas contain three blank spaces requiring the full name, street address, and state of residence where the Landlord and Tenant live (respectively).

3 – The Leased Premises Should Be Adequately Discussed

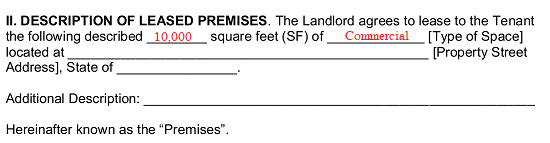

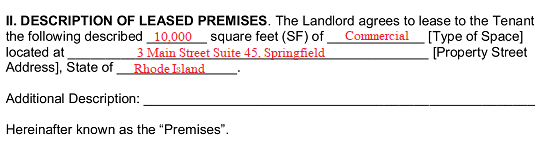

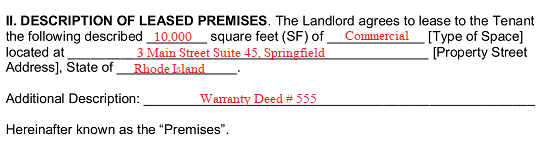

The second article (“II. Description Of Leased Premises”) will also need direct input. Here, we will focus on the leased property. Consult your records then produce the number of square feet that make up the leased premises on the first blank space in this section then, on the second blank space, define what “Type Of Space” the leased premises is.  Record the exact street address where the leased property can be visited on the empty line attached to the label “Property Street Address” and the State where it this street address is located on the empty line after the term “…State Of”

Record the exact street address where the leased property can be visited on the empty line attached to the label “Property Street Address” and the State where it this street address is located on the empty line after the term “…State Of”  Any “Additional Description” (i.e. a legal description or structural description) can be included on the last blank line of this section.

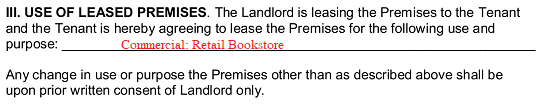

Any “Additional Description” (i.e. a legal description or structural description) can be included on the last blank line of this section.  The third article, “Use Of Leased Premises,” requires only one item for its completion. Use the blank space presented in this item as a place to document how the Tenant may use the premises for (i.e. retail business, hotel business, etc.).

The third article, “Use Of Leased Premises,” requires only one item for its completion. Use the blank space presented in this item as a place to document how the Tenant may use the premises for (i.e. retail business, hotel business, etc.).

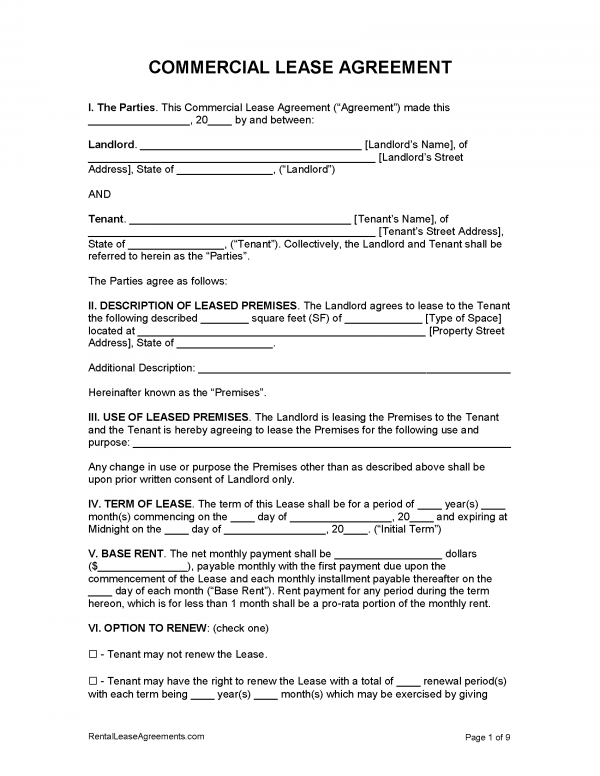

4 – Some Specifics Regarding This Lease Must Be Supplied

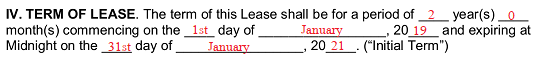

The next few articles will discuss the lease itself. The first of these requiring your attention is “IV. Term Of Lease” where you must fill in the number of years and (if applicable) months when this lease will be in effect on the first two blank spaces. Next, furnish the official first date when this lease becomes active across the three spaces that follow the term “…Commencing On The” and the last calendar date when it is effective on three lines after the phrase “…Expiring At Midnight On The”

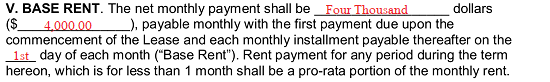

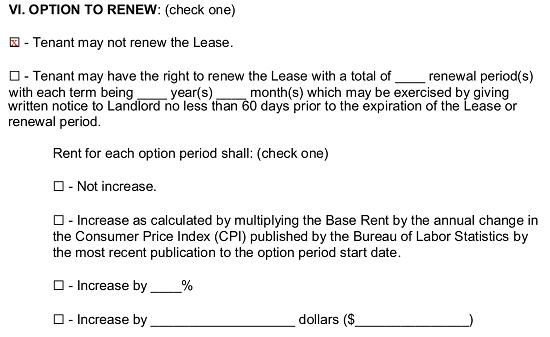

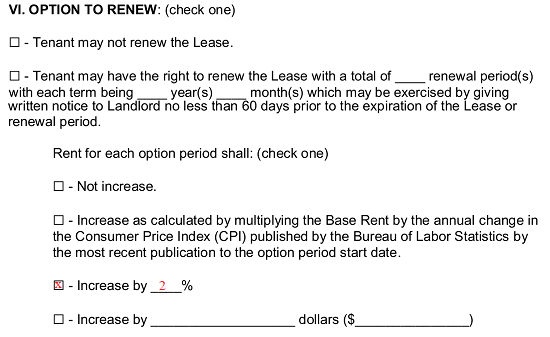

The article titled “V. Base Rent” will focus on the amount of money the Tenant is to pay the Landlord to occupy the leased premises. You will need to define this amount as a monthly payment amount by writing it on the first empty line in this article and fill it in numerically on the second blank line. Additionally, this article will require you document the calendar day of each month on the third blank space. Note: In the example below, the rent will be due on the first of every month.  Article “VI. Option To Renew” is concerned with the whether the Tenant will have the ability to continue this agreement or not and if so, under what conditions would such a continuation require. Several options are contained in this area that will each describe a possible scenario to apply to this document. Only one of these statements should be check marked so that it can be applied to the agreement between the Landlord and Tenant mentioned above.

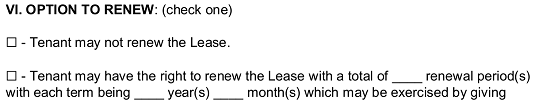

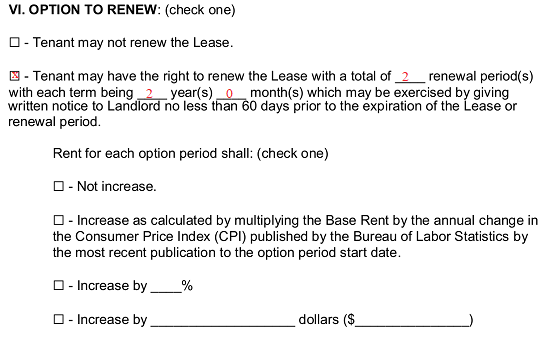

Article “VI. Option To Renew” is concerned with the whether the Tenant will have the ability to continue this agreement or not and if so, under what conditions would such a continuation require. Several options are contained in this area that will each describe a possible scenario to apply to this document. Only one of these statements should be check marked so that it can be applied to the agreement between the Landlord and Tenant mentioned above.  If the Tenant will not be given the option to request and enter a lease renewal with the Landlord, then mark the first statement’s checkbox.

If the Tenant will not be given the option to request and enter a lease renewal with the Landlord, then mark the first statement’s checkbox. Place a check mark in the second statement of this article if the Tenant will be given the opportunity to renew this lease. If this is the case, some additional information must be input to complete the language in this sentence. The three empty lines here require the number of renewal periods the Tenant will be allowed for these terms then the number of years and months each such term will be applied. Note: The number of years and months each renewed version of this lease remains active can differ from the term of this original lease.

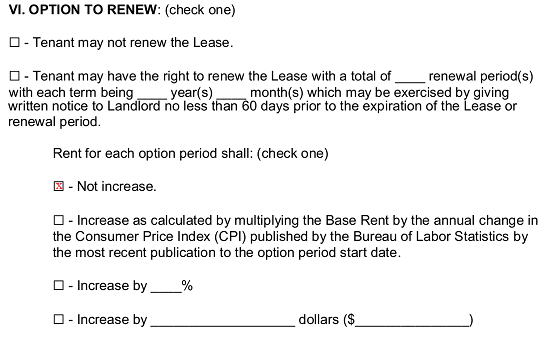

Place a check mark in the second statement of this article if the Tenant will be given the opportunity to renew this lease. If this is the case, some additional information must be input to complete the language in this sentence. The three empty lines here require the number of renewal periods the Tenant will be allowed for these terms then the number of years and months each such term will be applied. Note: The number of years and months each renewed version of this lease remains active can differ from the term of this original lease. We will continue with another four check-box statements that serve to define the amount of rent that must be charged in each renewal. Again, only one of these statements can be selected. If the rent will not increase during a renewal option, then mark the first of these checkboxes.

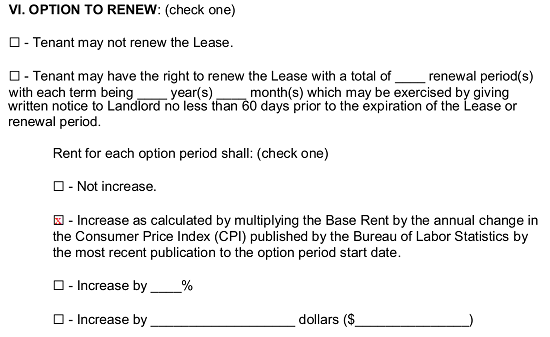

We will continue with another four check-box statements that serve to define the amount of rent that must be charged in each renewal. Again, only one of these statements can be selected. If the rent will not increase during a renewal option, then mark the first of these checkboxes. If it will be subject to an increase that is the product of the current base rent multiplied by the latest annual CPI change (as per the Bureau Of Labor Statistics) then mark the second checkbox.

If it will be subject to an increase that is the product of the current base rent multiplied by the latest annual CPI change (as per the Bureau Of Labor Statistics) then mark the second checkbox.  The rent in a future renewal of this lease can be set to increase by a certain percentage of the current amount. If so, then mark the third checkbox in this section of this list and report the percentage that will applied to the rent amount should the Tenant take up the option to renew this lease.

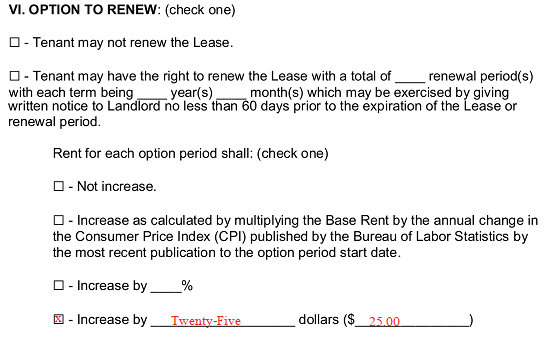

The rent in a future renewal of this lease can be set to increase by a certain percentage of the current amount. If so, then mark the third checkbox in this section of this list and report the percentage that will applied to the rent amount should the Tenant take up the option to renew this lease.  The last check box provides a scenario where the rent will go up by flat dollar amount if the Tenant renews this agreement. Mark this check box to apply this statement then, produce the dollar amount of such a rent increase by writing it out and entering it numerically on the first and second blank spaces respectively.

The last check box provides a scenario where the rent will go up by flat dollar amount if the Tenant renews this agreement. Mark this check box to apply this statement then, produce the dollar amount of such a rent increase by writing it out and entering it numerically on the first and second blank spaces respectively.  The section with the bold label “VII. Expenses” will address the additional costs of maintaining a commercial property. Each of these parties should agree to how such costs should be handled before this agreement is active. Therefore, three passages, each with a corresponding check box will describe three different ways these costs can be handled by the Landlord and Tenant. One of these passages must be marked and applied to the agreement being signed here.

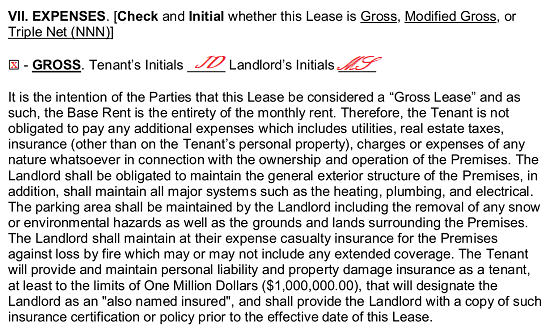

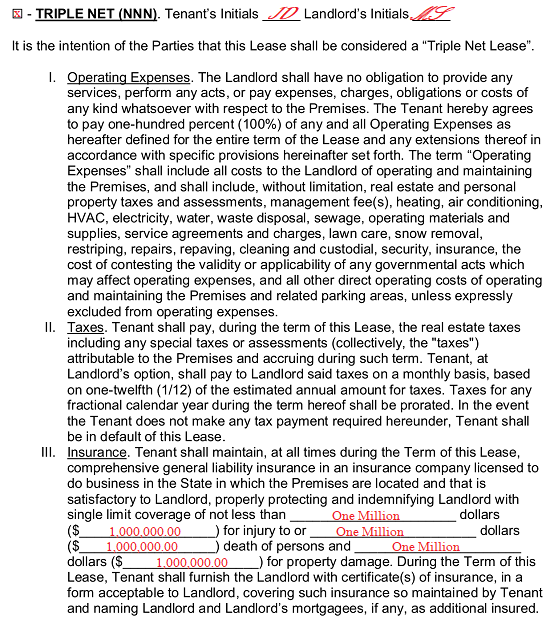

The section with the bold label “VII. Expenses” will address the additional costs of maintaining a commercial property. Each of these parties should agree to how such costs should be handled before this agreement is active. Therefore, three passages, each with a corresponding check box will describe three different ways these costs can be handled by the Landlord and Tenant. One of these passages must be marked and applied to the agreement being signed here.  If this lease is to set additional expenses (such as utilities, electrical systems, plumbing systems, and grounds maintenance) as the Landlord’s responsibility then, the first check box “Gross” must be marked and both parties must initial the blank line labeled “Tenant’s Initials” and “Landlord’s Initials.”

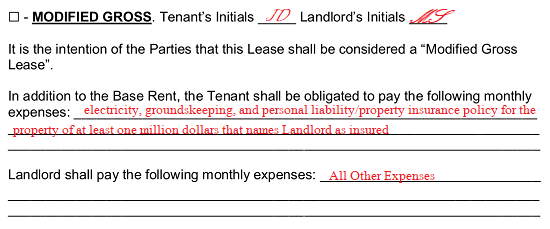

If this lease is to set additional expenses (such as utilities, electrical systems, plumbing systems, and grounds maintenance) as the Landlord’s responsibility then, the first check box “Gross” must be marked and both parties must initial the blank line labeled “Tenant’s Initials” and “Landlord’s Initials.”  The second option can be applied if the Landlord and Tenant have agreed to each pay some of these additional expenses. In this case, the “Modified Gross” check box must be marked. Additionally, the additional costs the Tenant must pay must be listed on the first set of blank lines leaving the Landlord’s responsibilities to be documented on the second set of blank lines. After this information is supplied, both parties should review it then initial the appropriately labeled blank spaces. Notice in the example, the Tenant will be responsible to pay for electricity, groundskeeping, and personal liability/property insurance policy for the property of at least one million dollars that names Landlord as insured as well while the landlord will assume all additional costs.

The second option can be applied if the Landlord and Tenant have agreed to each pay some of these additional expenses. In this case, the “Modified Gross” check box must be marked. Additionally, the additional costs the Tenant must pay must be listed on the first set of blank lines leaving the Landlord’s responsibilities to be documented on the second set of blank lines. After this information is supplied, both parties should review it then initial the appropriately labeled blank spaces. Notice in the example, the Tenant will be responsible to pay for electricity, groundskeeping, and personal liability/property insurance policy for the property of at least one million dollars that names Landlord as insured as well while the landlord will assume all additional costs.

If the Tenant will be held responsible for the additional costs (including taxes and insurance) then mark the third check box (“Triple Net (NNN)”). Several figures will be required by the third part in this option. The first figure should be the single limit coverage minimum amount named in a general liability insurance policy the Tenant must obtain and maintain to the Landlord’s satisfaction, the second figure will be the minimum injury amount of this policy, and the third figure will be the death of a person minimum amount of this policy. Each of these will need to be supplied (in this order) first written out and entered numerically. When this information has been supplied, both parties must initial this choice to approve its application to this agreement.

5 – Provide Legally Required Definitions Where Required

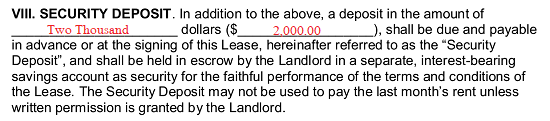

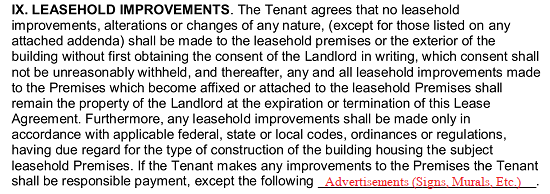

The eighth article of this paperwork will be labeled “VIII. Security Deposit” and will present two empty lines. Use this area to record the amount of money the Tenant must submit to the Landlord as a safeguard against damages or lack of funds. This dollar amount will be legally required to be returned to the Tenant if he or she is not at fault for any damages to the property and has been financially responsible throughout the lease.  Normally, the Tenant will be held responsible for any alterations to the property regardless of the reason (i.e. advertisements, improvements, etc.). If there will be any exceptions to the Tenant’s obligations when a leasehold improvement is required then, list it on the blank line in article “IX. Leasehold Improvements.”

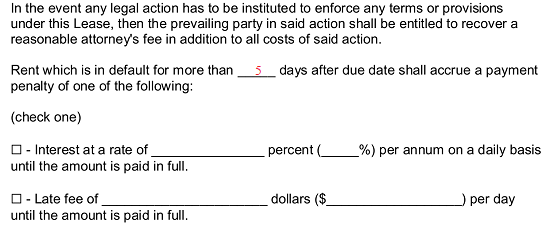

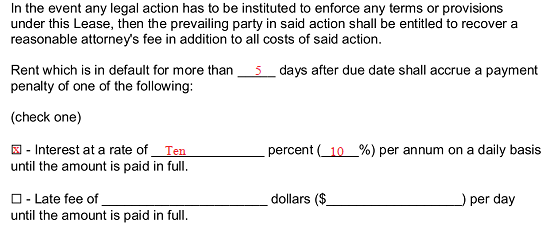

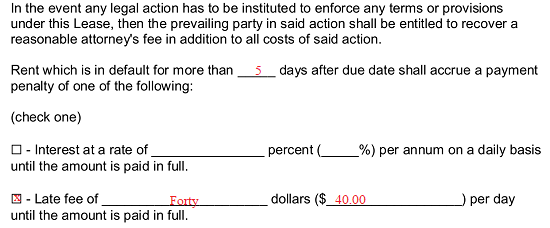

Normally, the Tenant will be held responsible for any alterations to the property regardless of the reason (i.e. advertisements, improvements, etc.). If there will be any exceptions to the Tenant’s obligations when a leasehold improvement is required then, list it on the blank line in article “IX. Leasehold Improvements.”  Find the fifteenth article of this lease (“XV. Default And Possession”) where additional information detailing the event of a Tenant’s late payment will be covered. Near the end of this article, the number of days after a missed rent payment when the lease will be considered in default must be input to the blank space before the words “…Days After Due Date Shall Accrue.” Once this number is recorded, one of the two following checkboxes must be marked and supplied with information to document the consequences the Tenant must face when he or she has defaulted on the rent.

Find the fifteenth article of this lease (“XV. Default And Possession”) where additional information detailing the event of a Tenant’s late payment will be covered. Near the end of this article, the number of days after a missed rent payment when the lease will be considered in default must be input to the blank space before the words “…Days After Due Date Shall Accrue.” Once this number is recorded, one of the two following checkboxes must be marked and supplied with information to document the consequences the Tenant must face when he or she has defaulted on the rent.

If there will be a late penalty calculated as a per annum interest rate, then mark the first box and fill in the percentage amount that will be applied in the spaces included in this statement.  If there will be a penalty that is a flat dollar rate, then select the second statement and record the dollar amount on the two empty lines in this statement.

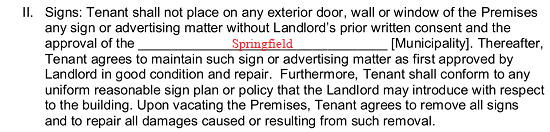

If there will be a penalty that is a flat dollar rate, then select the second statement and record the dollar amount on the two empty lines in this statement. The nineteenth article (“XIX. Miscellaneous Terms”) will give us the opportunity to document which municipality will govern any signs or advertisements the Tenant publicly displays on the blank space in part “II Signs.”

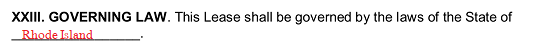

The nineteenth article (“XIX. Miscellaneous Terms”) will give us the opportunity to document which municipality will govern any signs or advertisements the Tenant publicly displays on the blank space in part “II Signs.” Locate the twenty third article titled with the bold words “Governing Law.” One blank line has been included in this article so that the name of the state whose court system will enforce and rule over this document and its contents may be properly featured as a part of this paperwork.

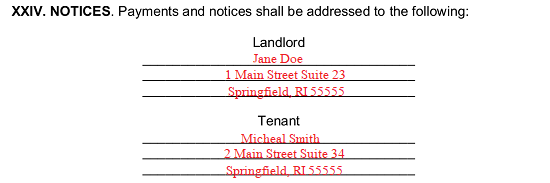

Locate the twenty third article titled with the bold words “Governing Law.” One blank line has been included in this article so that the name of the state whose court system will enforce and rule over this document and its contents may be properly featured as a part of this paperwork. The next section of this document, “XXIV. Notices,” must document the exact address where official notices being originated and delivered between these two parties must be sent. Thus, utilize the blank lines under the heading “Landlord” to record the full mailing address the Tenant must use when sending the Landlord an official notice regarding the lease or the property being leased while the blank lines underneath the “Tenant” require the full address the Landlord must use when sending the Tenant and official notice.

The next section of this document, “XXIV. Notices,” must document the exact address where official notices being originated and delivered between these two parties must be sent. Thus, utilize the blank lines under the heading “Landlord” to record the full mailing address the Tenant must use when sending the Landlord an official notice regarding the lease or the property being leased while the blank lines underneath the “Tenant” require the full address the Landlord must use when sending the Tenant and official notice.

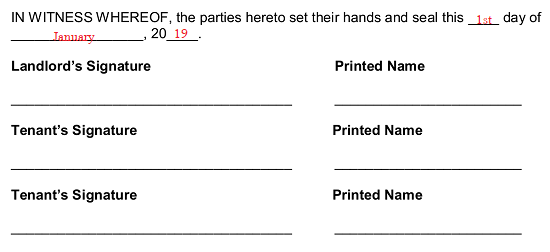

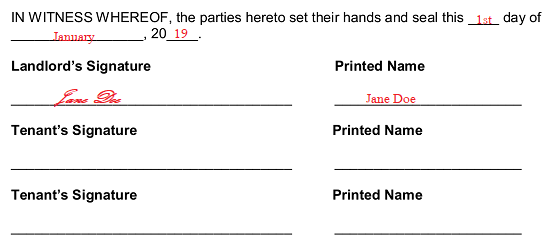

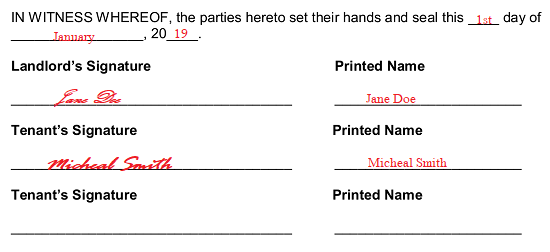

6 – The Landlord And Tenant Should Execute This Contract Together

The end of this contract will conclude with a statement requiring definitions. This statement should be filled out on the day the Landlord and Tenant sign their names to the area provided below it with the calendar date of signature. The Landlord must sign and print his or her name to the “Landlord’s Signature” line and the “printed Name” line.

Every Tenant participating in this lease must sign his or her name on the line labeled “Tenant’s Signature” then supply the printed version of his or her name to the blank line adjacent blank space.

Every Tenant participating in this lease must sign his or her name on the line labeled “Tenant’s Signature” then supply the printed version of his or her name to the blank line adjacent blank space.

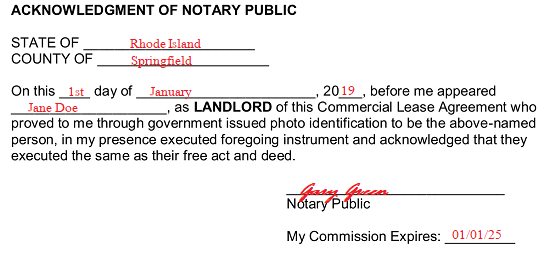

The next party to handle this document will be the Notary Public attending the signing. This is the only entity that can complete the “Acknowledgement Of Notary Public” section with the notarization process for the Landlord.  Notice that each party will have a separate notarization area.

Notice that each party will have a separate notarization area.